Futures net worth is a term that resonates strongly in the world of finance, particularly for investors who are keen on maximizing their wealth through strategic trading. In this article, we will delve deep into the concept of futures net worth, exploring its implications, benefits, and how it plays a critical role in modern investing. Understanding this concept is vital for anyone looking to enhance their financial portfolio and gain insights into the intricacies of futures trading.

Futures trading, unlike traditional stock trading, involves contracts that obligate the buyer to purchase, and the seller to sell, an asset at a predetermined future date and price. This financial instrument can be highly lucrative, but it also carries significant risk. This article aims to shed light on how futures trading can impact net worth over time, as well as provide practical tips for investors at all levels.

As we navigate through the nuances of futures net worth, we will discuss essential factors like market trends, risk management strategies, and the importance of research and analysis in making informed decisions. Each section is designed to equip you with the knowledge needed to effectively engage in futures trading and understand its potential to enhance your financial standing.

Table of Contents

- What is Futures Net Worth?

- How Futures Trading Works

- Factors Affecting Futures Net Worth

- Risk Management in Futures Trading

- Benefits of Futures Trading

- Futures Net Worth Calculation

- Case Study: Successful Futures Traders

- Conclusion

What is Futures Net Worth?

Futures net worth refers to the overall value of an investor's portfolio derived from futures contracts and related investments. It encompasses not only the profits gained from successful trades but also the potential losses incurred from unsuccessful ones. Understanding how to calculate and manage futures net worth is critical for anyone involved in this type of trading.

Key Components of Futures Net Worth

- Initial Investment: The amount of capital allocated to futures trading.

- Open Positions: Current contracts held, which can either be profitable or at a loss.

- Market Value: The current market price of the underlying assets.

- Margin Requirements: The funds required to maintain open positions in the futures market.

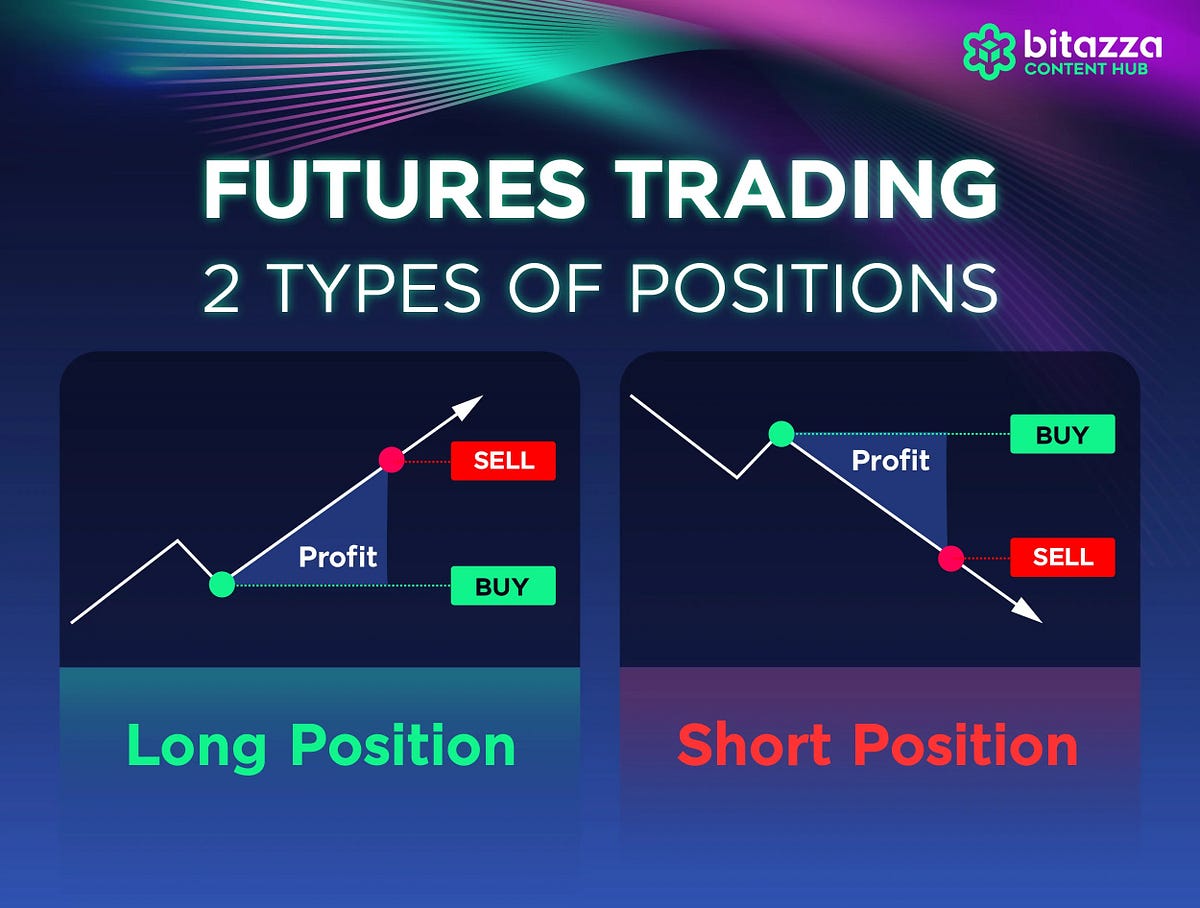

How Futures Trading Works

Futures trading operates on the principle of buying and selling contracts that specify the delivery of an asset at a future date. Here are the basic steps involved:

- Choosing a Market: Identify the asset you wish to trade, such as commodities, currencies, or stock indices.

- Opening a Brokerage Account: Select a reputable brokerage that offers futures trading.

- Placing Orders: Execute buy or sell orders based on market analysis.

- Monitoring Positions: Continuously track market movements and adjust your strategy accordingly.

- Closing Positions: Close your contracts to realize profits or limit losses.

Factors Affecting Futures Net Worth

Several factors can significantly impact an investor's futures net worth:

- Market Volatility: Fluctuations in market prices can lead to quick gains or losses.

- Leverage: The ability to control larger positions with a smaller amount of capital can amplify both profits and losses.

- Economic Indicators: Reports on employment, inflation, and GDP can influence market trends.

- Geopolitical Events: Political instability or changes in trade policies can affect market performance.

Risk Management in Futures Trading

Effective risk management is essential in futures trading to protect your net worth. Here are some strategies to consider:

- Setting Stop-Loss Orders: Automatically sell a position when it reaches a predetermined loss to minimize potential damage.

- Diversification: Spread investments across different assets to reduce risk exposure.

- Position Sizing: Determine how much capital to allocate to each trade to manage risk effectively.

- Regular Market Analysis: Stay updated on market trends and adjust your strategies as needed.

Benefits of Futures Trading

Investing in futures offers several advantages, including:

- High Liquidity: The futures market is highly liquid, allowing for quick entry and exit from positions.

- Leverage Opportunities: Futures trading allows traders to control larger amounts of capital with a smaller initial investment.

- Diverse Asset Classes: Futures contracts are available for a wide range of assets, providing ample investment options.

- Hedging Potential: Futures can be used to hedge against price fluctuations in the underlying asset.

Futures Net Worth Calculation

Calculating futures net worth involves assessing your total assets, including open positions and cash reserves, against any liabilities. Here’s a simple formula:

Futures Net Worth = Total Assets - Total Liabilities

To accurately assess your net worth, consider the following:

- Current Value of Open Positions: Sum the market values of all contracts held.

- Cash Reserves: Add available cash set aside for trading.

- Liabilities: Subtract any outstanding margin debts or loans.

Case Study: Successful Futures Traders

To illustrate the potential of futures trading, let’s look at a couple of successful traders who have built significant net worth through this investment method:

Trader A: The Commodity Specialist

This trader focused primarily on agricultural commodities, leveraging market analysis and trends to make informed decisions. By understanding seasonal patterns and weather impacts, Trader A was able to consistently profit, growing their net worth substantially over five years.

Trader B: The Index Trader

Trader B concentrated on stock index futures, utilizing technical analysis to identify entry and exit points. Through disciplined trading and effective risk management, Trader B achieved impressive returns, significantly increasing their financial portfolio.

Conclusion

Understanding futures net worth is crucial for anyone looking to engage in futures trading. By grasping the mechanics of futures contracts, the factors that influence market behavior, and effective risk management strategies, investors can significantly enhance their financial standing. Whether you are a novice or a seasoned trader, continuous learning and adaptation are key to success in the dynamic world of futures trading.

We invite you to share your thoughts in the comments below, and don't forget to check out our other articles for more insights into financial investments!

Thank you for reading! We hope to see you back on our site for more valuable information related to trading and investments.